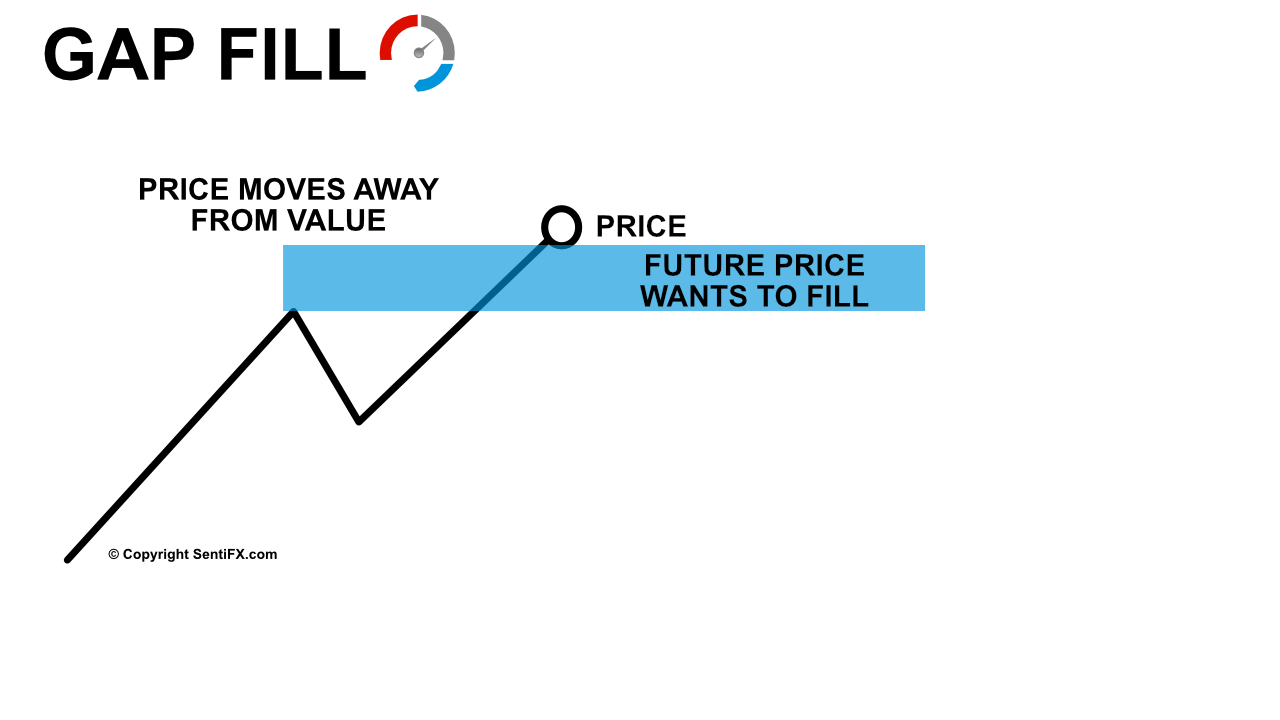

It’s highly unlikely that the price will keep increasing for an extended period at the same pace at which it gapped up.Įven if the company continues growing, investors in the market will eventually start to question whether it makes sense for them to spend such a high price for new shares. By purchasing more shares, they push the price up.Īt some point, a gap up stock will slow its ascent, plateau or start to fall. They don’t want to miss an opportunity to earn money from a successful company, so they buy more shares. investors agree that the company’s shares were priced too low the previous day. The event that energized investors during off-market hours doesn’t go away when the U.S. Gap Up Stocks Continue Gaining Value Gap up stocks continue gaining value when investors believe that the company still has room to grow. The stock’s price changes erratically as the market tries to find the correct value.The stock experiences a correction and the price goes down.The price continues to move upward throughout the day.What Happens When a Stock Gaps Up? Several things can happen when a stock gaps up. When earnings are down, foreign investors lose interest, or a company is negatively affected by a challenge, the stock can open gap down. An example of something that would cause excitement is when Apple ( AAPL) releases a new phone or new product entirely. Realistically, anything that contributes to a bullish perspective can make a stock open gap up. Good news that indicates a company may have avoided a potential challenge, such as overcoming a supply chain obstacle or winning or a lawsuit.Increased buys on foreign markets that operate while U.S.Press releases introducing new products or services that fill a need within a company’s industry.Earnings reports that show the company generated more profit than expected over a quarter.Some specific reasons that stocks open gap up include: That’s a very general definition because a broad range of events can excite investors and push stock prices up. Why Do Stocks Open Gap Up? Stocks open gap up because something has excited investors outside of the trading market’s operating hours. Many investors look for gap down patterns so they can purchase stock at reduced prices. With a gap down pattern, today’s opening price is lower than the previous day’s closing price. Gap down stocks are essentially the opposite of gap up socks. You should note that gap down patterns happen, too. The noteworthy change in price could indicate that something important happened outside of the usual trading hours. You would, however, want to pay close attention to a stock with a gap up pattern showing an increase of several dollars.

More often than not, you wouldn’t pay attention to tiny gaps that only add a few cents to a stock’s price. What Is a Gap Up Pattern? Gap up patterns show that a stock’s price has increased from the previous day’s closing value to the current day’s opening value. With some research and experience, you might find that you can make gap up stocks an important part of your investment portfolio. For example, Company A is a gap up stock if it closes at $500 on Monday and opens at $510 on Tuesday.īefore buying gap up stocks, you should take some time to learn about gap up patterns, why stocks open gap up, and popular ways other people earn money from gap up stocks.

Gap up stocks are stocks with prices that open higher than the previous day’s closing price.

0 kommentar(er)

0 kommentar(er)